Bank of England Base Rate

It is currently 05. Notes about our data.

Bank Of England Raises Rates For Third Time To Fight Inflation The New York Times

Transition to sterling risk free rates from LIBOR.

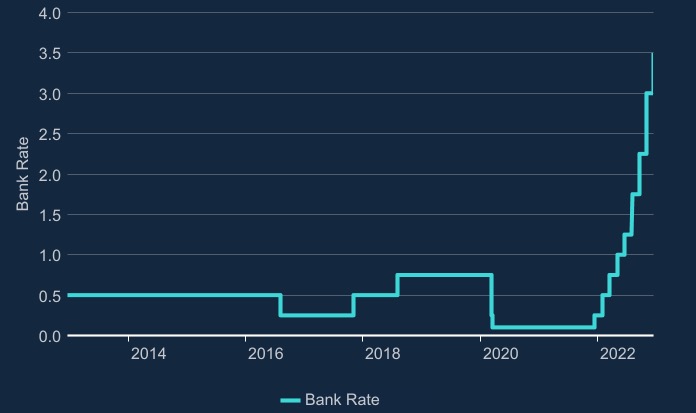

. On 3rd November 2022 the Bank of England BOE raised the base rate from 225 to 3 the biggest rise in over 30 years. We will notify you in advance of changes to any of our. The BoE was one of the first major central banks to start unwinding pandemic-era ultra-loose monetary policy and Bank Rate currently sits at 225 up from the 010 it was slashed to as COVID-19.

On certain products our interest rates are linked to the Banks Base Rate which is influenced by changes to the Bank of England Base Rate. Its part of the Monetary Policy action we take to meet the target that the Government sets us to keep inflation low and stable. It is the base rate of interest for the UK economy and has a strong impact on the short and long-term interest rates charged by commercial banks.

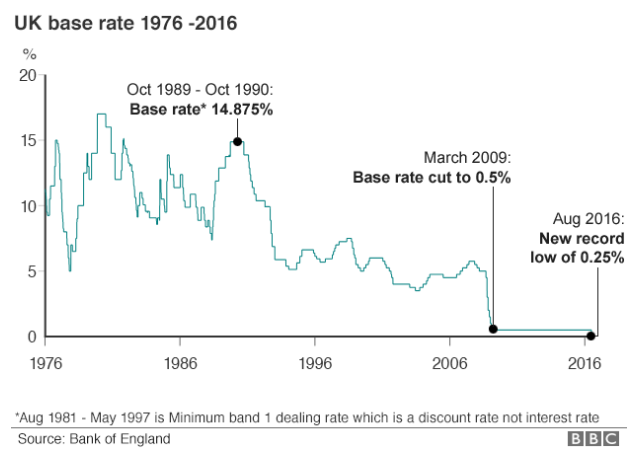

The bank rate was raised in November 2021 to 025. The key difference between bank rate and base rate is that the bank rate is the rate at which the central bank in the country lends money to commercial banks while. Interest and exchange rates data.

The Bank of England base rate is currently. Bank of England Market Operations Guide. The BoE can change the base rate at Monetary Policy Committee MPC meetings which generally happen eight times a year.

The MPC has now raised interest rates at its last eight meetings during which time the official cost of. Bank Rate determines the interest rate we pay to commercial banks that hold money with us. The days of cheap mortgage rates appear to be over for homebuyers as markets expect interest rates to go even higher next week as the Bank of England meets.

Subscribe to XML download changes. How often does the BoE base rate change. The Bank of England currently predicts that inflation will remain at around 10 for the rest of the year before slowly starting to fall.

Bank of England raises interest rates to 3 in largest single move for 30 years video. The recent rise could mean interest payments increase on certain types of mortgages and loans. The Bank of England uses the base rate to influence how much people spend and as a consequence keep inflation rates in line with the Government target of 2.

If the Banks Base Rate changes your monthly payment may be affected if you hold a mortgage loan or savings product. The Bank of England is preparing to further raise interest rates over concerns that inflation could become embedded in the British economy despite the growing risks of a prolonged recession its. The Monetary Policy Committee MPC was forced to raise interest rates in an attempt to reduce the UKs annual inflation rate which at the time sat at 101.

Our Monetary Policy Committee MPC sets Bank Rate. Inflation stood at 101 in the 12 months to September 2022 according to the most recent figures from the Office for National Statistics. The base rate was increased from 225 to 3 on November 2022.

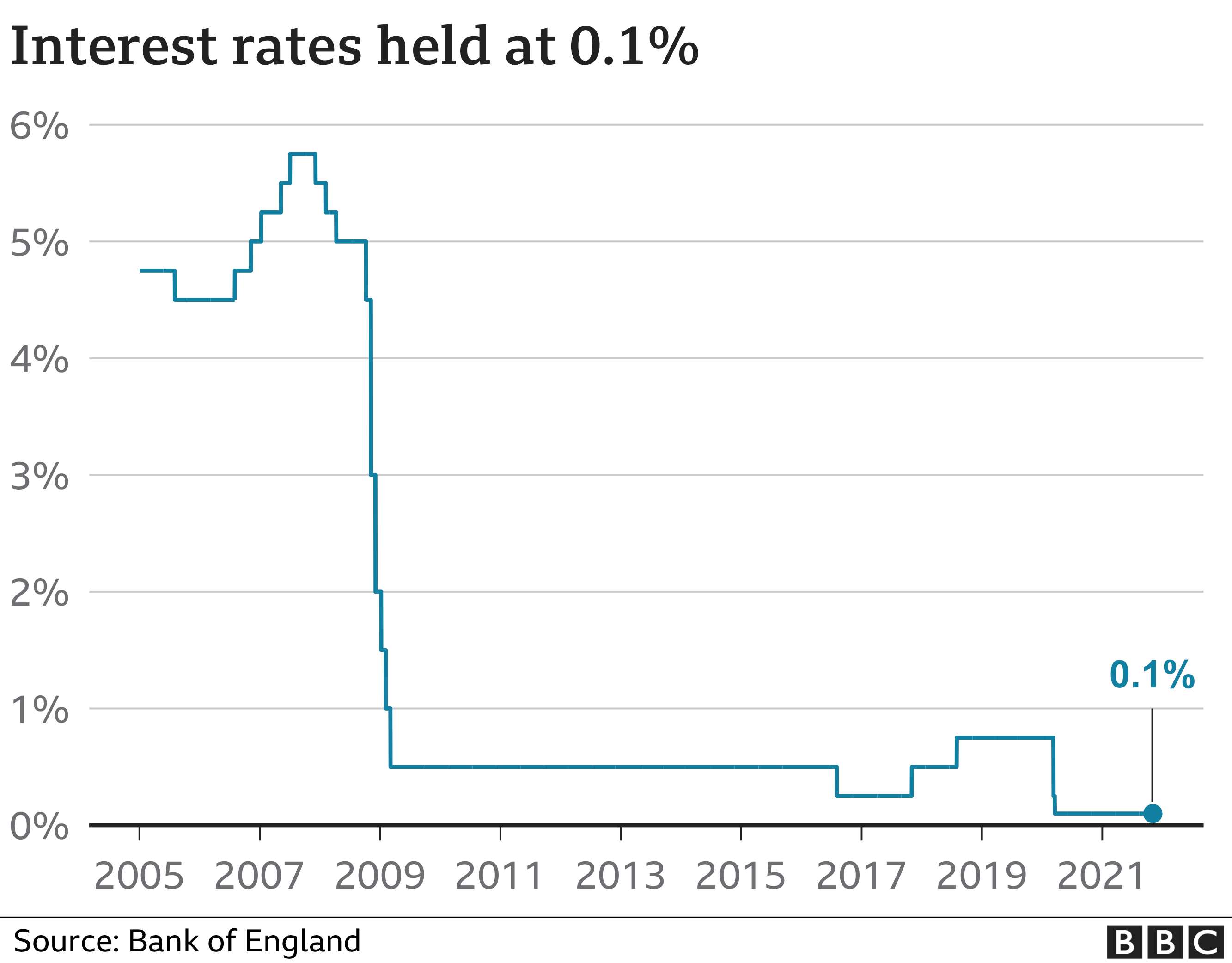

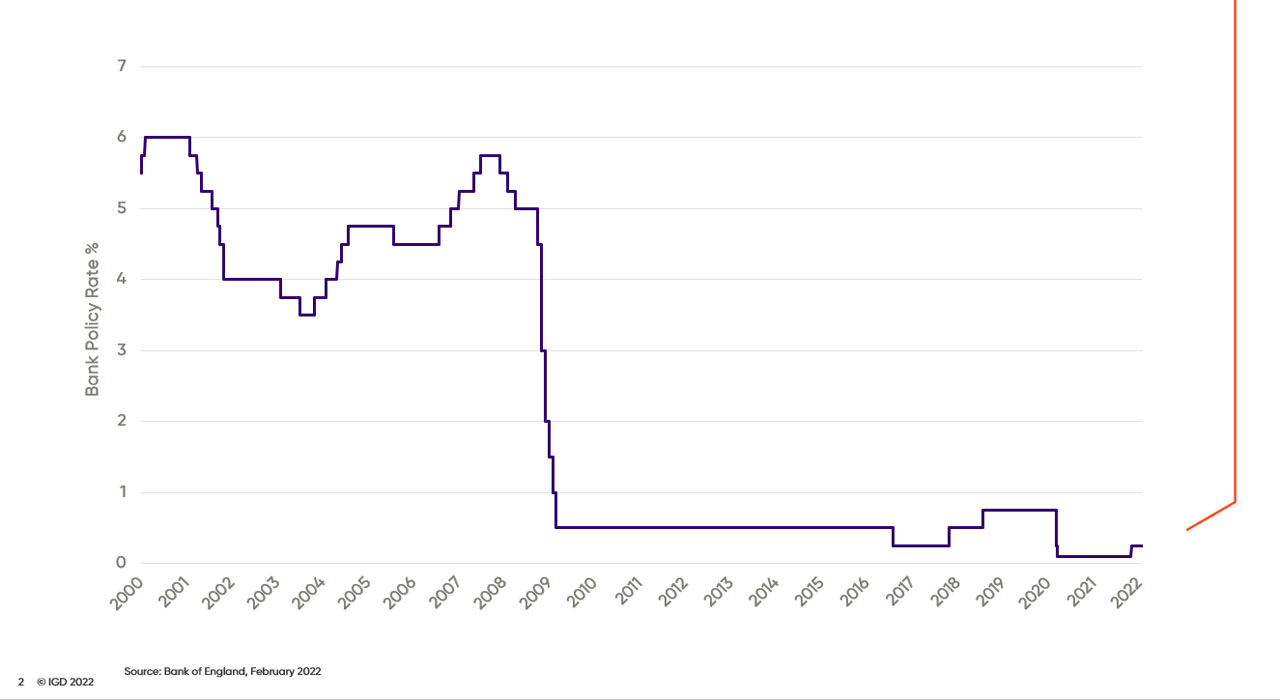

The base rate is the Bank of Englands official borrowing rate. Interest rates were on hold at 01 from March 2020 to December 2021 before they started rising again. Base rate rises will affect most mortgages unless theyre fixed.

The base rate does not change every time the Bank of England meets. The Banks Base Rate is currently 300. The Bank of England base rate is currently at a high of 3.

Official Bank Rate history. SONIA interest rate benchmark. Knowledge regarding bank rate and base rate is important for both borrowers and lenders in order to understand how these rates are affected by various economic conditions and government policies.

Financial markets currently price in a. It could rise to 075 in 2022 bringing it back to pre pandemic levels. The rise has matched the increase implemented by the US Federal Reserve Fed in its recent decision.

The base rate was previously reduced to 01 on 19 March 2020 to help control the economic shock of the coronavirus pandemic. Bank of England Statistics. It influences the rates those banks charge people to borrow money or pay on their savings.

Results and usage data. According to the November Monetary Policy Report published by BoE prices in September had risen by 101. The bank reduced the base rate from 075 to 025 1 week earlier on 11 March 2020.

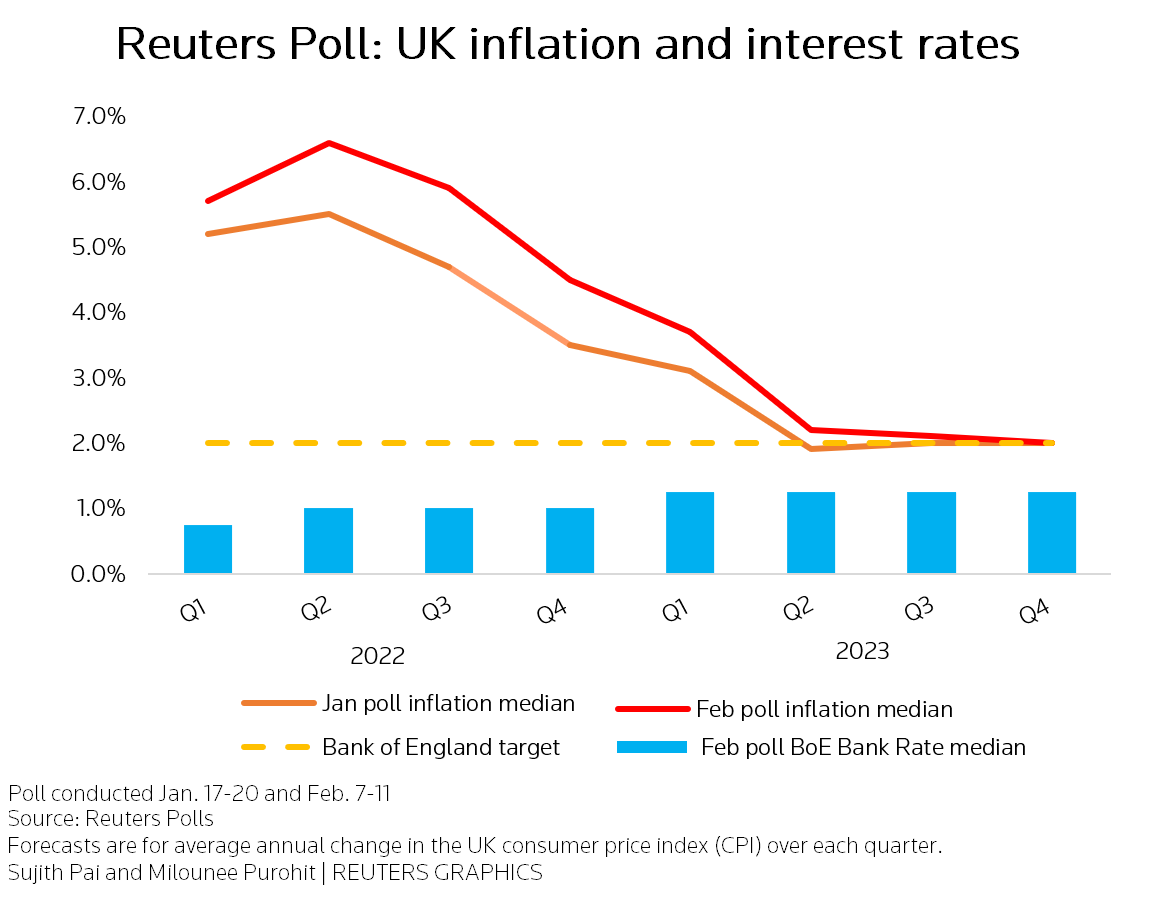

A Reuters poll published on Wednesday showed a majority of economists thought the BoE will raise rates again next month to 35 from 30 although almost a quarter of them said a bigger rate hike. The Bank of England Base Rate BOEBR also known as the official bank rate is the rate of interest charged by the BoE to commercial banks for overnight loans. It strongly influences UK interest rates offered by mortgage lenders and monthly repayments.

The Bank of England BoE raised interest rates by 75 basis points bps in its November meeting taking the rate to a new 14-year high of 3. The Bank of England has raised the base rate of interest by 075 percentage points to 3 - the single biggest increase in more than three decades - and said that the UK is already in recession.

Bank Of England Base Rate Uk Interest Rate Changes

Bank Of England To Raise Rates By 50bps Again To Tame Inflation Reuters Poll Reuters

Boe Official Bank Rate Aktuelle Und Historische Zinsen Der Bank Of England

Bank Of England Set For Biggest Interest Rate Rise In 27 Years

Base Rate Held As Boe Predicts Stronger Economic Recovery Mortgage Solutions

Traders Bet On 2pc Interest Rates After Us Inflation Exceeds Worst Expectations

Bank Of England Interest Rate Predictions 1 25 By End Of 2022 Says Capital Economics

Bank Of England Base Rate Drops To 0 25 Cambridge Mortgage Brokers Turney Associates

1m Libor And Bank Of England Base Rate Download Scientific Diagram

Official Bank Rate Wikiwand

Bank Of England Hints At Future Interest Rate Rise Bbc News

Hdfmvcm8f3afrm

Bank Of England Increases Interest Rates Amid Inflation Concerns

Bank Of England Preview Edging Towards A 2022 Rate Hike Article Ing Think

Uk Bank Rate Since 1694 The Uk Stock Market Almanac

How The Bank Of England Set Interest Rates Economics Help

Boe To Raise Rates Again In March Inflation To Peak Soon After Reuters